totravelme.ru Tools

Tools

Aarp Medigap Plans Reviews

The chart below shows basic information about the different benefits Medigap policies cover. = the plan covers % of this benefit. Medicare Supplement insurance is also called “Medigap”. It is sold by private insurance companies designed to cover the costs left over after Medicare Part A. I have had the same plan for two years now and my premiums are $0/month. So far so good. The Dental coverage, if you can call it that, went down. Review important Alerts, Advisories & Press Releases that impact Seniors. AARP/United Healthcare Insurance Company. Customer Service Phone Number: (). See AARP Medicare Supplement Insurance plans where you live – and compare costs and benefits side by side. If you have traditional or original Medicare (Part A and/or B), including Medicare supplement insurance (Medigap) plans, you will have coverage for care from. Medigap plans are standardized which means a G plan with AARP will be identical to a G plan with Blue Shield (aside from the one-off plans like G Extra, etc.). Benefits and costs vary depending on the plan and rider(s) you choose. Compare AARP® Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance. Is AARP United Healthcare Medicare supplimental insurance as bad as the customer reviews say?? Medigap plans can vary in cost greatly - sometimes by. The chart below shows basic information about the different benefits Medigap policies cover. = the plan covers % of this benefit. Medicare Supplement insurance is also called “Medigap”. It is sold by private insurance companies designed to cover the costs left over after Medicare Part A. I have had the same plan for two years now and my premiums are $0/month. So far so good. The Dental coverage, if you can call it that, went down. Review important Alerts, Advisories & Press Releases that impact Seniors. AARP/United Healthcare Insurance Company. Customer Service Phone Number: (). See AARP Medicare Supplement Insurance plans where you live – and compare costs and benefits side by side. If you have traditional or original Medicare (Part A and/or B), including Medicare supplement insurance (Medigap) plans, you will have coverage for care from. Medigap plans are standardized which means a G plan with AARP will be identical to a G plan with Blue Shield (aside from the one-off plans like G Extra, etc.). Benefits and costs vary depending on the plan and rider(s) you choose. Compare AARP® Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance. Is AARP United Healthcare Medicare supplimental insurance as bad as the customer reviews say?? Medigap plans can vary in cost greatly - sometimes by.

The AARP/United Health Care Medicare supplement Plan F is among the highest priced in the country, yet they just canceled Silver Sneakers coverage. This will. Medicare Supplement Plans. Offered in Massachusetts. Comparison of Plans. Core. Supplement 1* Supplement 1A. Basic Benefits Included In All Plans. You can return the policy within 30 days of receipt and receive a full refund. Minnesota Medigap insurance policies United Healthcare AARP®*. A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. AARP/UnitedHealthcare offers all Medicare Supplement plans. AARP/UnitedHealthcare plans offer extras such as hearing program, a 24/7 nurse line and fitness. Best Overall: AARP/UnitedHealthcare · Ratings: A+ from AM Best, stars from NCQA · Discounts: Multi-policy, electronic funds transfer and annual payer. The best time to enroll in a Medigap plan is during the first six months you UnitedHealthcare Insurance Co (AARP)3. A. B. D. G. K. L. M. N. C. The decreasing sign up discount is a killer. My husband was 67 when he signed up for plan F with AARP/UHC. Initial monthly premium was about. AARP Medicare Advantage from UHC plans cover features and benefits in addition to those included in Original Medicare. Review sample discounted costs by procedure in your area Bring your AARP Medicare Supplement Insurance Plan ID card so the dental office can verify your. AARP Medicare Supplement Plans are ideal for those whose Medicare Part A and B plans are inadequate. These plans provide additional coverage to reduce your. Learn about the wellness extras, like gym memberships and discounts, available as part of an AARP® Medicare Supplement Insurance Plan from UnitedHealthcare. AARP endorses the AARP Medicare Supplement Plans insured by UnitedHealthcare Insurance Company, Asylum Street, Hartford, CT (available in all states/. UnitedHealthCare Insurance Company of New York(AARP) (Group Association), 6, X Medicare Supplement Premium Comparison Tables (Updated August ). AARP has top-rated customer service and many positive reviews from current members. The way they treat their members is a significant reason for the success of. AARP plans are NOT the most expensive. I ran a cost comparison for Plan F with all the carriers in my area. Only 3 were less expensive and they offered far. AARP generally offers lower costs than many other carriers, especially when it comes to out-of-pocket costs like copayments. So, if you want an affordable. Find AARP Medicare Insurance Agents. Find local agents to compare AARP Medicare Advantage - Medicare Supplement and other plans and costs. Recommended Reviews - AARP Medicare Supplement Plans insured by UnitedHealthcare My Medigap application was lost, miss-identified, etc., etc., until I. Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

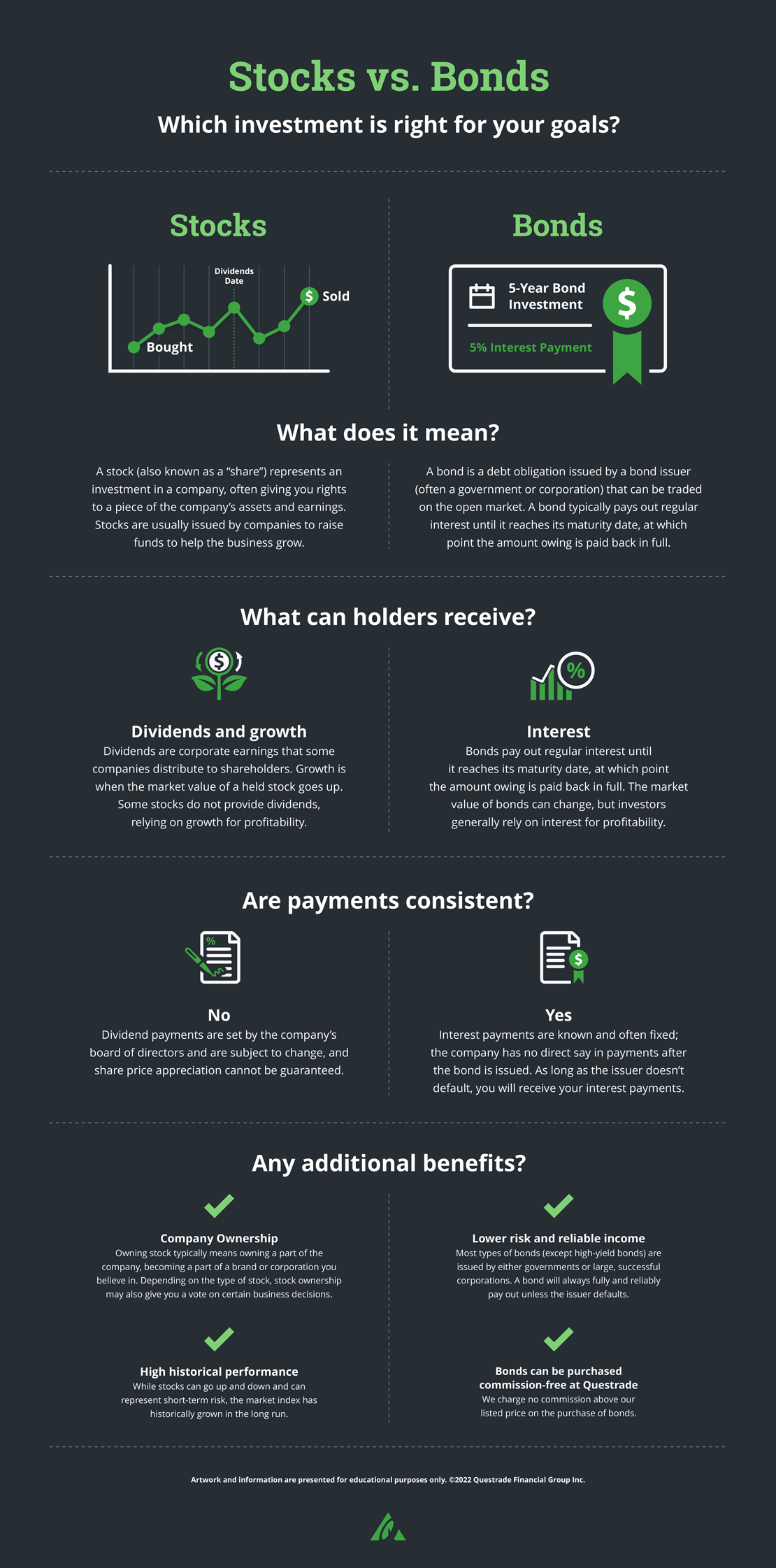

Basics Of Stocks And Bonds

In the long run, stocks may provide you with a greater return on investment than securities like bonds can offer. Common stocks of major corporations are. What are some tips for investing in bonds? · Know when bonds mature. · Know the bond's rating. · Investigate the bond issuer's track record. · Understand your. Learn how to invest in stocks with this comprehensive beginner's guide. Discover the essential steps, tips, and strategies to start growing your wealth. Bonds are basically borrowing agreements. A bond is established as a contract between two parties where the one party lends money to the other in exchange for. Asset allocation: This refers to how you divide up your portfolio among different asset classes, such as stocks, bonds, and cash alternatives, to help you work. Stocks are ownership shares in a company, while bonds are a kind of loan from investors to a company or government. To make a profit from stocks, you'll need to. Unit 6: Stocks and bonds · Introduction to stocks · What it means to buy a company's stock · Shorting stock · Shorting stock · Understanding company statements and. While stocks are ownership in a company, bonds are a loan to a company or government. Because they are a loan, with a set interest payment, a maturity date, and. This step-by-step guide for beginners can get you investing in the stock market, whether you want to use an online brokerage, robo-advisor or financial. In the long run, stocks may provide you with a greater return on investment than securities like bonds can offer. Common stocks of major corporations are. What are some tips for investing in bonds? · Know when bonds mature. · Know the bond's rating. · Investigate the bond issuer's track record. · Understand your. Learn how to invest in stocks with this comprehensive beginner's guide. Discover the essential steps, tips, and strategies to start growing your wealth. Bonds are basically borrowing agreements. A bond is established as a contract between two parties where the one party lends money to the other in exchange for. Asset allocation: This refers to how you divide up your portfolio among different asset classes, such as stocks, bonds, and cash alternatives, to help you work. Stocks are ownership shares in a company, while bonds are a kind of loan from investors to a company or government. To make a profit from stocks, you'll need to. Unit 6: Stocks and bonds · Introduction to stocks · What it means to buy a company's stock · Shorting stock · Shorting stock · Understanding company statements and. While stocks are ownership in a company, bonds are a loan to a company or government. Because they are a loan, with a set interest payment, a maturity date, and. This step-by-step guide for beginners can get you investing in the stock market, whether you want to use an online brokerage, robo-advisor or financial.

These are the most common tools of the trade and the basic building blocks of your portfolio. You'll also hear them referred to as asset classes. Before you. Shares are issued by firms, priced daily and listed on a stock exchange. Bonds, meanwhile, are effectively loans where the investor is the creditor. In return. The easiest way to understand bond prices is to add a zero to the price quoted in the market. For example, if a bond is quoted at 99 in the market, the price is. stocks and bonds and other elements of the market. There have been a number basic for carrying out certain investment processes. Depending on its. Stocks offer an opportunity for higher long-term returns compared with bonds but come with greater risk. Bonds are generally more stable than stocks but have. In general, bonds are usually seen as a less volatile investment than stocks. This is due to the stability of the bond market, and the fact that stock prices. “Equity” is a way to describe ownership, and “equities” are an alternative name for stocks. Companies can also issue bonds to raise capital, although buying. Stocks and Bonds for Beginners: Basics of investing in stock market. Bond investment. Trading crash course for beginners. Stock market day trading. When an investor buys a stock, part ownership in the form of a share is bought. · Bonds are a type of investment designed to aid governments and corporations to. A bond is a debt security, like an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you. The greatest difference between stocks and bonds are their risk levels and their return potential. Speaking very generally, stocks have historically offered. You will learn about growth and dividend stocks and how to use market data. After completing this course, you will have an understanding of the two fundamental. When most people talk about investing, they're usually referring to investments in stocks, bonds and investment funds, which are all types of securities. If you. An introduction. What are stocks and bonds? 3. Determining the differences stock basics. 5. Understanding stocks bond basics. 9. Understanding bonds managing. Stocks differ from other investment classes, such as bonds, in several key ways. And no two individual stocks are exactly alike. That makes it important for. Why buy bonds? Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they. Companies can complete multiple secondary offerings of their stock when they need to raise additional funding, provided investors are willing to buy. Meanwhile. The most fundamental difference between stocks and bonds is the nature of the money used to purchase the instrument. In stocks, the money you invest buys you a. If you are young and saving for a long-term goal such as retirement, you may want to hold more stocks than bonds. Investors nearing or in retirement may want to. Stocks are equity instruments and can be considered as taking ownership of a company. While bonds are issued by all types of entities – including governments.