totravelme.ru Recently Added

Recently Added

High Yield Reit Stocks

They can provide added diversification, potentially higher total returns, and/or lower overall risk. In short, their ability to generate dividend income along. BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. This high dividend payout requirement means a larger share of REIT investment returns come from dividends when compared with other stocks. In fact, over the. Hoya Capital High Dividend Yield ETF (Ticker: RIET) invests in select high dividend yielding real estate securities. RIET expects to pay monthly. Real estate investment trusts (REITs) can offer a unique combination of attractive yields, diversification, and capital appreciation. But is REIT investing. High-yield REITs (real estate investment trusts) have proven they belong in a diversified portfolio. The prevalence of REITs on major stock exchanges. Which UK REIT pays the highest dividends? Name, Market Cap (£m), Dividend Highcroft Investments, , , Commercial. Drum Income Plus, , Hoya Capital High Dividend Yield ETF (Ticker: RIET) invests in select high dividend yielding real estate securities. RIET expects to pay monthly. They can provide added diversification, potentially higher total returns, and/or lower overall risk. In short, their ability to generate dividend income along. BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. This high dividend payout requirement means a larger share of REIT investment returns come from dividends when compared with other stocks. In fact, over the. Hoya Capital High Dividend Yield ETF (Ticker: RIET) invests in select high dividend yielding real estate securities. RIET expects to pay monthly. Real estate investment trusts (REITs) can offer a unique combination of attractive yields, diversification, and capital appreciation. But is REIT investing. High-yield REITs (real estate investment trusts) have proven they belong in a diversified portfolio. The prevalence of REITs on major stock exchanges. Which UK REIT pays the highest dividends? Name, Market Cap (£m), Dividend Highcroft Investments, , , Commercial. Drum Income Plus, , Hoya Capital High Dividend Yield ETF (Ticker: RIET) invests in select high dividend yielding real estate securities. RIET expects to pay monthly.

Which UK REIT pays the highest dividends? Name, Market Cap (£m), Dividend Highcroft Investments, , , Commercial. Drum Income Plus, , REITs offer a way to include real estate in one's investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments. REIT Dividend Stocks, ETFs, Funds ; Prologis IncPrologis. PLD · $ %. $ B ; AMERICAN TOWER CORPORATIONAMERICAN TOWER. AMT · $ +%. REITs make up % of my portfolio. The two REITs I own did quite well last year with one (SPG) up 24% capital appreciation and 6% dividends and. REITs make up % of my portfolio. The two REITs I own did quite well last year with one (SPG) up 24% capital appreciation and 6% dividends and. # Franklin BSP Realty Trust Inc (NYSE:FBRT) — % YIELD Benefit Street Partners Realty Trust is a real estate finance company that primarily originates. Portfolio of High-Yield Health Care REITs ; Name & Monthly Returns. Symbol & Snapshot. Dividend (Yield) & Dividend Chart ; Medical Properties Trust · MPW · $ In March , the average REIT paid a dividend yield of %. While it's possible to find REITs with yields as high as 10% or more, these payments are less. Apple Hospitality REIT is a hotel REIT that owns a portfolio of hotels with tens of thousands of rooms located across dozens of states. It franchises its. EPR Properties (NYSE: EPR) and W. P. Carey (NYSE: WPC) currently yield more than 6%. They should be able to sustain and grow those big-time payouts, making them. REITs are able to generate higher yields due in part to the favorable tax structure. These trusts own cash-generating real estate properties. Accessibility. Easterly Government Properties Dividend stocks don't come much more safe than Easterly Government Properties (NYSE:DEA). The company is a real estate. # Franklin BSP Realty Trust Inc (NYSE:FBRT) — % YIELD. Benefit Street Partners Realty Trust is a real estate finance company that primarily originates. I see Iron Mountain as the most undervalued high-yield REIT on the market currently. Income-oriented investors should look further into it to see if it fits. For this reason, they tend to have a high dividend yield, usually somewhere in the 5% – 15% range. Taxes: Again, REITs are not taxed at the entity level as long. The securities listed in this page include stocks, ETFs, Active ETFs and mutual funds. Stocks include common stocks, ADRs REITs, MLPs and preferred shares. The Nikkei High Yield Index is a REIT index comprised of high yield REITs calculated by Market Cap multiplied by Yield Weight Methodology. Tracks common stocks of U.S. companies that have paid above-average dividends for the previous 12 months, excluding REITs. Tracks common stocks of U.S. Real estate investment trusts (REITs) are an attractive option for investors seeking high dividend payouts. Unlike many traditional stocks and bonds, REITs. Real estate investment trusts (REITs) are an attractive option for investors seeking high dividend payouts. Unlike many traditional stocks and bonds, REITs.

Seperately Managed Accounts

SMA accounts typically require a minimum investment of $k for equity and fixed income strategies, although the specific minimum account size varies by. Separately Managed Accounts. This website is for informational purposes only and is not a solicitation for any product or service. We offer a full range of separately managed strategies that you won't find everywhere- including equity, fixed income, multi-asset, responsible investing and. A separately managed account (SMA) is a portfolio of individual securities managed independently on your behalf by a professional asset-management firm. A variety of Separately Managed Account (SMA) offerings, which provide investors direct ownership, transparency, and potential tax efficiency. Within our Managed Account services, Sprott Wealth Management provides Separately Managed Accounts (SMA) that enable you to invest in our model portfolios. With. A separately managed account is a portfolio of individual securities managed on your behalf by a professional asset management firm. Tax-Smart SMAs, powered by 55ip IMPORTANT INFORMATION: Separately Managed Accounts (SMAs) are not mutual funds. SMAs are discretionary accounts managed by. Separately managed accounts offer you more control over your investments and taxes. What makes SMAs unique? Direct ownership of stocks or bonds. Fund. SMA accounts typically require a minimum investment of $k for equity and fixed income strategies, although the specific minimum account size varies by. Separately Managed Accounts. This website is for informational purposes only and is not a solicitation for any product or service. We offer a full range of separately managed strategies that you won't find everywhere- including equity, fixed income, multi-asset, responsible investing and. A separately managed account (SMA) is a portfolio of individual securities managed independently on your behalf by a professional asset-management firm. A variety of Separately Managed Account (SMA) offerings, which provide investors direct ownership, transparency, and potential tax efficiency. Within our Managed Account services, Sprott Wealth Management provides Separately Managed Accounts (SMA) that enable you to invest in our model portfolios. With. A separately managed account is a portfolio of individual securities managed on your behalf by a professional asset management firm. Tax-Smart SMAs, powered by 55ip IMPORTANT INFORMATION: Separately Managed Accounts (SMAs) are not mutual funds. SMAs are discretionary accounts managed by. Separately managed accounts offer you more control over your investments and taxes. What makes SMAs unique? Direct ownership of stocks or bonds. Fund.

PGIM Investments brings a diversified approach with multiple Separately Managed Account strategies to meet varying needs. Parametric's custom SMA portfolios meet investor needs through ongoing account management, including active tax management, trading and execution (including. T. Rowe Price separately managed accounts (SMAs) bring tactical flexibility to our research-driven, risk-aware active investment process. Separately Managed Accounts(8) Separately Managed Accounts (SMAs) are offered by BNY Mellon Securities Corporation in its capacity as a registered investment. BlackRock's separately managed accounts (SMAs) empower you to personalize and tax-efficiently manage portfolios to best serve your most demanding HNW clients. Separately Managed Accounts. Global Franchise ADR & International Franchise ADR. Share. Global Franchise ADR Separately Managed Account. Learn more. Also known as separately managed accounts (SMAs), they are increasingly targeted toward more affluent retail investors and come with a wrap fee of 1%–3% per. Amundi US offers model-delivery SMAs as well as single- and dual-contract SMAs through a diverse range of actively managed equity and fixed income strategies. AllianceBernstein offers separately managed accounts (SMAs) for customized investment solutions tailored to your needs. Find the SMA that is right for you. Separately managed accounts (SMAs) play an important role in providing investors choice in how they access professional investment management. They also offer. Separately managed accounts (SMAs) are a potentially powerful way to outsource part of your investment portfolio to professional managers. Separately managed account In the investment management industry, a separately managed account (SMA) is any of several different types of investment accounts. Separately Managed Accounts · Assets Under Management. Number of Years Managing SMA · Our Products. Lord Abbett offers Financial Advisors access to our. For those portfolios of individually managed securities, SEI makes recommendations as to which manager will manage each asset class. SEI may recommend the. Separately managed accounts (SMAs) play an important role in providing investors choice in how they access professional investment management. They also offer. Tailored SMAs to Accommodate a Range of Investor Objectives. A Separately Managed Account (SMA) is a unique investment vehicle that opens the door for more. PGIM Investments brings a diversified approach with multiple Separately Managed Account strategies to meet varying needs. View Principal Asset Management separately managed accounts (SMAs). Download SMA fact sheets and SMA commentary. They are investment accounts that are managed separately – they are accounts managed for a specific person or institution. They are investment accounts that are managed separately – they are accounts managed for a specific person or institution.

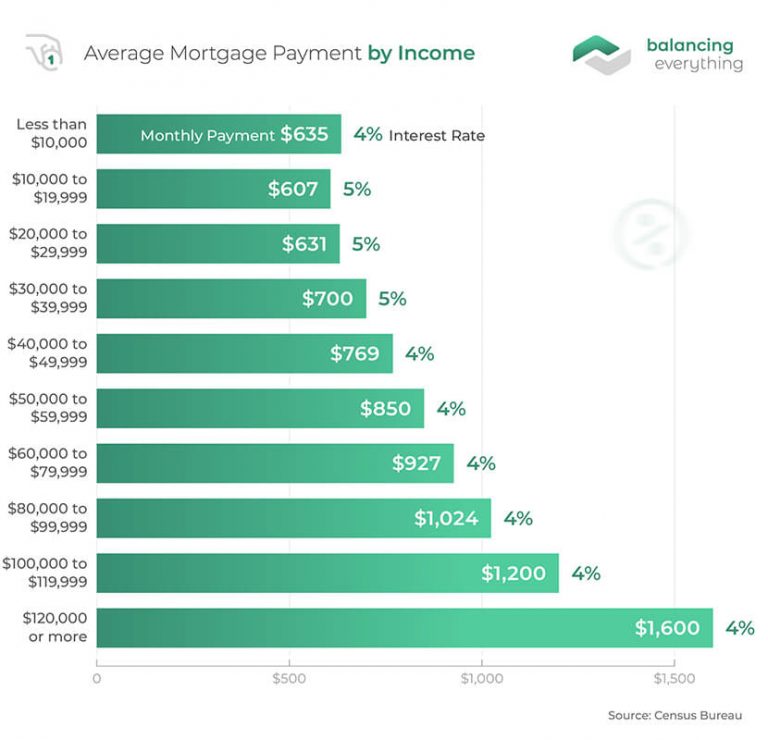

How Much To Pay In Mortgage

Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. How do you calculate monthly mortgage payments · Determine your principal. · Calculate your monthly interest rate by dividing the annual interest rate by To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. A mortgage payment is a payment you make on a loan that enables you to purchase a house. This payment consists of the principal amount of the loan and interest. Calculate your mortgage payment amount and the impact of optional additional prepayments. Use the amortization schedule to find out the principal and interest. Understanding how much your regular mortgage payments will be is crucial to getting a mortgage that you can afford. Use the Mortgage Calculator to determine. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. The 28% rule The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to. Use our mortgage payment calculator to estimate how much your payments could be. Calculate interest rates, amortization & how much home you could afford. How do you calculate monthly mortgage payments · Determine your principal. · Calculate your monthly interest rate by dividing the annual interest rate by To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. A mortgage payment is a payment you make on a loan that enables you to purchase a house. This payment consists of the principal amount of the loan and interest. Calculate your mortgage payment amount and the impact of optional additional prepayments. Use the amortization schedule to find out the principal and interest. Understanding how much your regular mortgage payments will be is crucial to getting a mortgage that you can afford. Use the Mortgage Calculator to determine. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. The 28% rule The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to.

Use Investopedia's mortgage calculator to see how different inputs for the home price, down payment, loan terms, and interest rate would change your monthly. Using a percentage of your income can help determine how much house you can afford. For example, the 28/36 rule suggests your housing costs should be limited to. A mortgage payment is a payment you make on a loan that enables you to purchase a house. This payment consists of the principal amount of the loan and interest. Calculate your mortgage payments based on how much you borrow, your interest rate, mortgage term and payment schedule. This rule says that your mortgage payment shouldn't go over 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps your lender. mortgage can be as long as 35 years. Payment Frequency. You can choose how often you will make payments on your mortgage. Typically your overall interest paid. A mortgage payment is a regularly scheduled payment that a homeowner makes to repay a home loan, or mortgage. This payment typically occurs on a monthly basis. Calculate mortgage payments, compare repayment scenarios and find out how you can save on interest. This calculator determines your mortgage payment and provides you with a mortgage payment schedule. The calculator also shows how much money and how many years. Simulate mortgage payments, estimate mortgage loan insurance costs and explore various payment frequencies. Whether you're buying your first home or. They may impact your offer, down payment and how much mortgage you qualify for. How much is your down payment? Avoid paying mortgage default insurance with a. How a Larger Down Payment Impacts Mortgage Payments* ; 15%, $30,, $,, $ ; 10%, $20,, $,, $ Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Use MoneyHelper's mortgage calculator to find out how much your monthly mortgage payment will be based on the house price and how much deposit you've paid. A mortgage repayment is the regular payment made by you (the borrower) to the lender (such as a bank) to repay the money you borrowed. This includes any. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Mortgage Payments Calculator. An easy, peasy way to get really useful numbers. See what impacts your monthly payment, how much principal you might pay over. Calculate your mortgage payments based on how much you borrow, your interest rate, mortgage term and payment schedule. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Your down payment has to be at least 5% of the purchase price for homes worth $, or less. For homes worth more than $,, the minimum down payment.

How Much To Replace Flooring In Home

Totals - Cost To Install Laminate Flooring, SF, $, $1, ; Average Cost per Square Foot, $, $ home. Not sure it's in your budget? At Lowe's, we offer Special Financing options to help make hardwood flooring installation a reality for many homeowners. Installing a new floor costs $3, on average, but can range between $1, and $4,, depending on the room size and type of flooring. How we get this data. You may have to replace a large section of the flooring, which can be costly, and fumigate your home to get rid of termites. The average cost to repair termite. Average Total Project Cost: $ - $ per sq. ft. Installation: $ - $ per sq. ft. Materials: $ per sq. ft. Underlayment: $ per sq. ft. Totals - Cost To Install Vinyl Tile Flooring, SF, $1,, $1, ; Average Cost per Square Foot, $, $ On average, you can expect to pay between $5, and $12,, including materials and installation. Premium hardwoods and complex installations. The cost to refloor a house is $16, to $67,, which is a substantial range based largely on material quality and labor costs. This range is for the typical. Hardwood flooring costs typically range from $7 to $25 per square foot, but most homeowners will pay around $16 per square foot on average. Totals - Cost To Install Laminate Flooring, SF, $, $1, ; Average Cost per Square Foot, $, $ home. Not sure it's in your budget? At Lowe's, we offer Special Financing options to help make hardwood flooring installation a reality for many homeowners. Installing a new floor costs $3, on average, but can range between $1, and $4,, depending on the room size and type of flooring. How we get this data. You may have to replace a large section of the flooring, which can be costly, and fumigate your home to get rid of termites. The average cost to repair termite. Average Total Project Cost: $ - $ per sq. ft. Installation: $ - $ per sq. ft. Materials: $ per sq. ft. Underlayment: $ per sq. ft. Totals - Cost To Install Vinyl Tile Flooring, SF, $1,, $1, ; Average Cost per Square Foot, $, $ On average, you can expect to pay between $5, and $12,, including materials and installation. Premium hardwoods and complex installations. The cost to refloor a house is $16, to $67,, which is a substantial range based largely on material quality and labor costs. This range is for the typical. Hardwood flooring costs typically range from $7 to $25 per square foot, but most homeowners will pay around $16 per square foot on average.

Hardwood floor installation costs between $5 and $20 per square foot. The nationwide average cost to install square feet of oak or maple hardwood flooring. Highland Hardwoods. Menu. Home · About · The Highland Blog · Why Highland · Our Story Give us a call if you are unsure how many square feet there are per. On average, the price for the materials alone ranges anywhere between $3 to $10 per square foot for low-end and mid-end options, while high-end engineered wood. You can search for flooring by the square foot at home depot, usually between $1 to about $5 per square foot depending on the flooring you. The national average flooring installation cost is around $7 per square foot or $3, per square feet, which includes the cost of both materials and labor. Installing flooring yourself costs from $ to $15 per square foot for materials, not including your prep and labor time. Hiring a local flooring company will. Should you add new flooring before selling your home? Find out if replacing your floors before listing your residential property for sale is truly worth it. The average total cost for installing or replacing new flooring is between $6 and $18 per square foot. The overall expense is influenced by factors such as the. The average cost to replace a subfloor runs between $ and $12 per totravelme.ru Some areas of the home are less expensive to replace than others. It is not just. As per your requirements, it may cost you approximately $3, on average to install carpet flooring in Toronto. Cork Flooring. If you're looking for an. Depending on your selections, the total cost for hardwood floor installation can average up to $4 - $6 per square foot. This Home Depot guide explains the. Tile Flooring. Tile floor installation, on average, can range from $8 to $44 per square foot. The national average cost to replace your flooring is $1, to $8,, with most people paying around $3, to replace hardwood flooring in a totravelme.ru How much does it cost to replace carpet with hardwood floor? Say What is the average cost of repairing or replacing flooring in a home? Use flooring samples to find the perfect look for your space. See our products in your home before you commit. Shop All Samples · We can install your flooring. What Are Home Flooring Costs Near Me? Flooring Cost. For residential flooring costs, the range averages between $3 and $15 per square foot and obviously depend. Average cost to install vinyl plank flooring is about $ ( totravelme.ru home, mid-range vinyl plank flooring). Find here detailed information about vinyl. Cost to Replace the Subfloor in a Mobile Home. Expect to pay between $2 and $ per square foot for both labor and materials. · Subfloor Replacement Labor. Hardwood floor installation costs $4, on average. This cost normally ranges from $2, to $7,, or between $6 and $25 per square foot for both labor. Average cost: $ · Low-end cost: $ · High-end cost: $1,

Wikipedia Stock Price

.svg/1200px-Stock_market_crash_(2020).svg.png)

The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. import quandl totravelme.ru_key = 'XXXXX' totravelme.ruwnload("WIKI",download_type="partial",filename="./totravelme.ru"). Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the shares [a] by which ownership of a corporation or company is divided. Welcome to the Stock page! Here you can find the Blox Fruits that are currently in stock at the Blox Fruit Dealer, as well as those that were in stock. Overall, the number of shares the company sells and the price for which shares sell are the generating factors for the company's new shareholders' equity value. Using my new super powers to automatically import stock prices into BigQuery, I went out to find what were the most correlated Wikipedia. A stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. Summary. Tables API. End of day stock prices, dividends and splits for 3, US companies, curated by the Quandl community and released into the. Stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. import quandl totravelme.ru_key = 'XXXXX' totravelme.ruwnload("WIKI",download_type="partial",filename="./totravelme.ru"). Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the shares [a] by which ownership of a corporation or company is divided. Welcome to the Stock page! Here you can find the Blox Fruits that are currently in stock at the Blox Fruit Dealer, as well as those that were in stock. Overall, the number of shares the company sells and the price for which shares sell are the generating factors for the company's new shareholders' equity value. Using my new super powers to automatically import stock prices into BigQuery, I went out to find what were the most correlated Wikipedia. A stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. Summary. Tables API. End of day stock prices, dividends and splits for 3, US companies, curated by the Quandl community and released into the. Stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices.

The Wikipedia sentiment value positively correlates to the stock price change for most of the companies for the most time. For example, the plots of Hewlett-. In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds. A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper. Stock Information · Stock Quote · Interactive Chart · Investment Calculator · Historical Stock Price · FAQs · Analyst Coverage · Contact · Careers. Contact. Updated daily, this database offers stock prices, dividends and splits for US publicly-traded companies. Tables. The entire WIKI database. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) - Find objective, share price, performance, expense ratio, holding, and risk details. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) - Find objective, share price, performance, expense ratio, holding, and risk details. Market capitalization is equal to the market price per common share multiplied by the number of common shares outstanding. Stock market prediction is the act of trying to determine the future value of a company stock or other financial instrument traded on an exchange. Stock market data systems communicate market data—information about securities and stock trades—from stock exchanges to stockbrokers and stock traders. Price–sales ratio, P/S ratio, or PSR, is a valuation metric for stocks. It is calculated by dividing the company's market capitalization by the revenue in. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation). There is. Rates & Bonds · Stocks · U.S. Markets · Wealth · Macro Matters. Latest in Markets. Hedge funds pile into bearish Japanese stock bets, bank says August 9, The price–earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company's share (stock) price to the company's earnings per share. stock market, either through individual stocks, mutual funds, or retirement accounts. price of the S&P for the preceding trading day. Level 1 and Level 2. Today's Best CD Rates · Today's Best Mortgage Rates · Best Practice stock trading with virtual money — trusted by over 3 million educated investors. Market capitalization is calculated by multiplying the share price on a selected day and the number of outstanding shares on that day. The list is expressed. stock market, either through individual stocks, mutual funds, or retirement accounts. price of the S&P for the preceding trading day. Level 1 and Level 2.

What Credit Cards Accept 600 Credit Score

Good builder/rebuilder cards are Discover and Capital One. Both creditors offer pre-approval tools that won't require a hard pull prior to. Individuals with a credit score can explore options such as credit unions, online lenders specializing in bad credit car loans, or working with auto lenders. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. That means the credit scores they accept may vary depending on their criteria. This doesn't just include credit cards—late or missed payments on other. Home Equity Loans · Other Loans · Student Loans · Loan Services · Credit Cards. Ready for your next vehicle? Check out our great Auto Loan rates. Services. Score Match: FICO Score Matches ; PREMIER Bankcard® Mastercard® Credit Card · to · Fair Credit, Average Credit ; PREMIER Bankcard® Gold Credit. What you can get with a to credit score is a solid unsecured credit card or a low-fee secured card that will allow you to build credit and, maybe, earn. Top 3 Credit Cards for a Credit Score · 1. Destiny® Mastercard® · 2. OpenSky® Secured Visa® Credit Card · 3. Milestone® Gold Mastercard®. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. Good builder/rebuilder cards are Discover and Capital One. Both creditors offer pre-approval tools that won't require a hard pull prior to. Individuals with a credit score can explore options such as credit unions, online lenders specializing in bad credit car loans, or working with auto lenders. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline. That means the credit scores they accept may vary depending on their criteria. This doesn't just include credit cards—late or missed payments on other. Home Equity Loans · Other Loans · Student Loans · Loan Services · Credit Cards. Ready for your next vehicle? Check out our great Auto Loan rates. Services. Score Match: FICO Score Matches ; PREMIER Bankcard® Mastercard® Credit Card · to · Fair Credit, Average Credit ; PREMIER Bankcard® Gold Credit. What you can get with a to credit score is a solid unsecured credit card or a low-fee secured card that will allow you to build credit and, maybe, earn. Top 3 Credit Cards for a Credit Score · 1. Destiny® Mastercard® · 2. OpenSky® Secured Visa® Credit Card · 3. Milestone® Gold Mastercard®. A FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline.

Capital One credit cards for fair credit include QuicksilverOne, Quicksilver Secured, and the Platinum Mastercard. Your credit score is only one of the many. With a credit score, you might be able to get a traditional credit card. While most credit card issuers don't publish minimum credit scoring standards, some. 38 votes, comments. What card gave you your highest starting limit. Include data prior to applying if possible: A) Fico score. Open a secured credit card. Doing so will help you to build more positive payment history. Make no more than one small purchase on the card each. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. Capital One Spark Classic for Business stands out as an ideal choice for business owners with fair credit. This card requires a fair credit score for approval. Credit cards to help build or rebuild credit can create a brighter financial future when handled responsibly. With a credit score, you're probably eligible for several credit card options designed to foster credit growth. The main cards are secured credit cards. How. People with a credit score – credit card with no credit check to apply · No annual fee or interest¹ · No credit check to apply · No minimum security deposit. Best for all credit types. Avant. ; Best for high close rates if pre-approved. Best Egg. 4 ; Best peer-to-peer lender. Prosper. ; Best bad credit personal. Our top choices for a new credit card if you have a credit score are the Petal 2 Visa and Capital One QuicksilverOne because they're easy to use and earn. The Capital One Platinum Credit Card is designed for consumers with fair or limited credit. It's an unsecured card, but it doesn't offer any rewards of any kind. Experts often recommend starting with a secured credit card if you have a credit score of These cards are easier to get approved for, and they can help you. Credit cards for fair/average scores ; Capital One QuicksilverOne Cash Rewards Credit Card · reviews · % - 5%. Cash back ; Milestone® Mastercard® · Reflex Platinum Mastercard · % Fixed · $75 - $ ; Platinum Prestige Mastercard Secured Credit Card · % Variable · $49 ; AvantCard · %* Variable · $39*. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. Visa Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Self - Credit Builder Account with Secured Visa® Credit Card · Wells Fargo Reflect®. This card requires a security deposit but is more accessible, even for those with fair or poor credit – a lower credit score for Discover card approval. 3. A credit score of is high enough for you to be considered for a credit card. But don't have any illusions — a score is still subprime, and the unsecured. How Can I Build Credit If I Have No Credit History? · Get a Secured Credit Card · Become an Authorized User · Apply for a Credit Builder Loan · Consider a Credit-.

Starting Your Own Meal Prep Business

Since you have about a dozen competitors, and more as the number of passionate chefs channel their skills into meal delivery or meal kit delivery services, you. A meal prep business plan is required for banks and investors. The document is a clear and concise guide of your food business idea and the steps you will take. Want to start a meal prep delivery business? Learn what you need, what to charge, how to limit liability—we've done the legwork for you. For those who are passionate about healthy eating and saving people time and money on meals, starting a meal prep business may be an exciting. exact questions to ask at a first consultation · what to look for in the kitchen tour · sample emails for scheduling a consultation and the first cook session. Whether you're creating pre-made meals that just need to be heated up, or providing the ingredients and recipe, you have the opportunity to be creative and come. How to get started · Write a business plan. Get an idea of what your business will be, what meals will you sell, who will your customers be, how much staff you. Our custom reporting system was created with your business model in mind. Our meal & ingredient Production Reports will provide your kitchen with the meals to. Building a Strong Online Presence · Build a Search Engine Optimization (SEO) friendly website · Include essential back-end features like different business. Since you have about a dozen competitors, and more as the number of passionate chefs channel their skills into meal delivery or meal kit delivery services, you. A meal prep business plan is required for banks and investors. The document is a clear and concise guide of your food business idea and the steps you will take. Want to start a meal prep delivery business? Learn what you need, what to charge, how to limit liability—we've done the legwork for you. For those who are passionate about healthy eating and saving people time and money on meals, starting a meal prep business may be an exciting. exact questions to ask at a first consultation · what to look for in the kitchen tour · sample emails for scheduling a consultation and the first cook session. Whether you're creating pre-made meals that just need to be heated up, or providing the ingredients and recipe, you have the opportunity to be creative and come. How to get started · Write a business plan. Get an idea of what your business will be, what meals will you sell, who will your customers be, how much staff you. Our custom reporting system was created with your business model in mind. Our meal & ingredient Production Reports will provide your kitchen with the meals to. Building a Strong Online Presence · Build a Search Engine Optimization (SEO) friendly website · Include essential back-end features like different business.

How to Start a Meal Prep Business · 1. Choose Your Meal Prep Business Concept · 2. Write a Meal Prep Business Plan · 3. Obtain Funding · 4. Find a Meal Prep. Ultimately, it may cost you about $68 for your first online order—definitely a smart business move to attract new customers. How to Start a Meal Prep Business? The Free Meal Prep Business Plan Outline · Executive Summary. This section will have two or three paragraphs outlining the business in a manner that leaves the. Prep is a Healthy Meal Prep Delivery Service. Our healthy, balanced meals deliver the proper nutrition needed to help optimize your performance. The best meal prep business model is going to start with creating your business name. Your name could change everything for you. You want a name that is easy to. Customized San Diego Meal Prep program full of tasty flavors as a jump start to anyone who would like to lose body fat while maintaining muscle. Subscribe now and enjoy our local meals starting at just $ per meal. see What people are saying. Excellent Service. As a manager at a business. Prep is a Healthy Meal Prep Delivery Service. Our healthy, balanced meals deliver the proper nutrition needed to help optimize your performance. I came up with the system when I was working as a private chef, cooking for everybody else and I would come home to an empty fridge and cranky family. I know I. Prep is a Healthy Meal Prep Delivery Service. Our healthy, balanced meals deliver the proper nutrition needed to help optimize your performance. Plan Your Meals: Decide which meals you want to prep (breakfast, lunch, dinner, snacks) and for how many days. · Create a Menu: Write down the. Learning the way to begin a meal prep commercial enterprise may be a variety of work, however, it can additionally be a profitable experience. Chef Inspired, Trainer Approved - The Carolina's #1 Meal Prep Company offering meal packages for delivery in South Carolina & North Carolina. Meal Prep Business Website Along with great apps and software to start your eCommerce food business, you'll need a solid website that presents your goods as a. Well, you cook it off. How much do you put in each portion? Maybe you put one quarter of that box in each portion. Okay. Well, how much did the box cost? One. The way to start is to make the food you want to eat and all it takes is ten recipes that you're passionate about making and selling. Some of your customers may. The next step in starting a meal prep business is to design a menu that will do well in the market niche that you've selected. At this stage, it's a good idea. Meal prep kits send you all the ingredients you need to cook a healthy meal. They will generally include specialty-crafted recipes, and most delivery services. Customized San Diego Meal Prep program full of tasty flavors as a jump start to anyone who would like to lose body fat while maintaining muscle. The management team section provides an overview of your meal prep business's management team. This section should provide a detailed description of each.

Investments With 7 Percent Return

7) AAA Bonds · Why invest: Potential for higher returns than government bonds · Risk of investing: Comparatively higher credit & default risk, sensitive to. investments but no more than you need to generate your desired rate of return. Frequently asked questions (FAQs). Are there high-yield, low-risk investments? You can get 7% at lower risk from a wide array of securities, including investment-grade bonds. Those can also be held in a retirement account. Related Materials-4,Paragraph Video Player-3 Investment return and principal value of an investment will fluctuate so that an investor's. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC. Average 7-day SEC yield as of Note that these figures don't represent the return on any particular investment and the rate of return is not guaranteed. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending December Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. 7) AAA Bonds · Why invest: Potential for higher returns than government bonds · Risk of investing: Comparatively higher credit & default risk, sensitive to. investments but no more than you need to generate your desired rate of return. Frequently asked questions (FAQs). Are there high-yield, low-risk investments? You can get 7% at lower risk from a wide array of securities, including investment-grade bonds. Those can also be held in a retirement account. Related Materials-4,Paragraph Video Player-3 Investment return and principal value of an investment will fluctuate so that an investor's. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC. Average 7-day SEC yield as of Note that these figures don't represent the return on any particular investment and the rate of return is not guaranteed. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ® (S&P ®) for the 10 years ending December Amount of money that you have available to invest initially. Step 2: Contribute. Monthly Contribution. Amount that you plan to add to the principal every month. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh.

While over the long term the stock market has historically provided around 10% annual returns (closer to 6% or 7% “real” returns when you subtract for the. Figure out your estimated annual percentage return. This figure depends on the type of investments you're considering. For example, the stock market has a. Learn about TIAA mutual funds, variable annuities, and TIAA Traditional by researching performance and investment profiles. “The highest rate of return in early childhood development comes from investing Professor Heckman's analysis of the Perry Preschool program shows a 7. Dividend stocks. Though not technically fixed-income investments, dividend stocks can be considered safe and offer an almost guaranteed rate of return. With. The average annual return on that investment would have been %. The 7/2/ 70, 96, 10/3/ 80, , 1/3/ 90, , 1. rate of return. Since , the average annual total return for the S&P , an unmanaged index of large U.S. stocks, has been about 10%. Investments that. return, based on the type of investments they select. Different assets A 7% return on a (k) falls within the average rate of return for most If returns on investments in your account over the next 35 years average 7 percent and expenses that reduce the rate of return of the investment option. They were designed to let you invest your entire portfolio in a single L Fund and get the best expected return for the amount of expected risk that is. For a guaranteed 7%? Nothing. There is no asset that will return a guarantee that high for every year on a long term basis. Things like passive. 7, $12,, $7, The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. 7 Tax-Free Investments to Consider for Your Portfolio. June 3, Rate of Return on Investments. Photo credit: © iStock/Farknot_Architect. When. 7% annually on TDA investments in the Fixed Return Fund. This rate has been in effect since December 11, ; the previous rate was %. Other members. In most instances, your investment account goes up because the investments within the account (stocks, mutual funds, bonds, etc) went up in value. This means. The rule of 72 is a shortcut investors can use to determine how long it will take their investment to double based on a fixed annual rate of return. All you do. Retirement assets accounted for 33 percent of all household financial assets Its members include mutual funds, exchange-traded funds (ETFs), closed. And on the far right you have a growth portfolio. Each model features its best returns, its worst returns, and its average annual return percentage. A 7% monthly return rounds off to approximately % returns a day. If you're having a capital of say k, you just need to achieve a profit. Enter an annual interest rate and an annual rate of inflation. Click Calculate. Value of initial investment.

What Are The Different Types Of Llc

Business owners in an LLC are not responsible for the debt of the company. Unlike a corporation, the business does not file separate taxes. Each partner (called. There are many types of business entities defined in the legal systems of various countries. These include corporations, cooperatives, partnerships, sole. Sole proprietorship · Partnership · Limited liability company (LLC) · Corporation · Cooperative. A limited liability company is a business formed by an organizer who may, but need not be a member. It is a business entity separate from its members. TYPES OF BUSINESS STRUCTURES · Sole Proprietor · Partnership · Corporation · Limited Liability Company (LLC). One of the first decisions you'll make when starting a new business is choosing an entity type. Generally, most entrepreneurs choose to form a Corporation. Corporation · Limited Liability Company (LLC) · Limited Partnership (LP) · General Partnership (GP) · Limited Liability Partnership (LLP) · Sole Proprietorship. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state. Business owners in an LLC are not responsible for the debt of the company. Unlike a corporation, the business does not file separate taxes. Each partner (called. There are many types of business entities defined in the legal systems of various countries. These include corporations, cooperatives, partnerships, sole. Sole proprietorship · Partnership · Limited liability company (LLC) · Corporation · Cooperative. A limited liability company is a business formed by an organizer who may, but need not be a member. It is a business entity separate from its members. TYPES OF BUSINESS STRUCTURES · Sole Proprietor · Partnership · Corporation · Limited Liability Company (LLC). One of the first decisions you'll make when starting a new business is choosing an entity type. Generally, most entrepreneurs choose to form a Corporation. Corporation · Limited Liability Company (LLC) · Limited Partnership (LP) · General Partnership (GP) · Limited Liability Partnership (LLP) · Sole Proprietorship. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state.

Each state has its own rules regarding LLCs, but the legal structure is similar. The owner of an LLC is a member, and LLCs can have one member or multiple. As a separate legal entity: a limited liability company or a corporation are the most common, and a nonprofit is a different type of corporation. A limited. Limited-Liability Company Types. First, identify the organizational structure you wish to form for applicable documents. File online for immediate service. This flexibility allows an LLC to accommodate multiple classes of equity interests as well as to provide for special tax allocations. Advantage Over Limited. The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. Learn about LLC, Sole Proprietorship, S corporation, C corporation, Nonprofit, and more. Compare different business types and decide which one is right for. Types of Business Entities/Structures · What is a corporation? · What is a limited liability company? · What is a partnership? · What is a general partnership? The limited liability company (LLC) is not a partnership or a corporation but rather is a distinct type of entity that has the powers of both a. This flexibility allows an LLC to accommodate multiple classes of equity interests as well as to provide for special tax allocations. Advantage Over Limited. Sole Proprietorship LLC General Corp. Limited Partnership S-Corp. C-Corp. Please slide or swipe. Common Types Of LLCs · Single Member LLC · Multi-Member LLC · Member-Managed LLC · Manager-Managed LLC. Limited Liability Company (LLC). A Limited Liability Company (LLC) is a business entity that offers certain limited personal liability on the part of the owner. These include family LLCs, holding company LLCs, and real estate LLCs. Here is an article about the different kinds of LLCs you can work with. Can an LLC Be an. LLCs can also offer different classes of membership interests. However, this is not so if you want to be taxed as an S corporation. The tax law requires S. There are different types of business entities, each with unique benefits and limitations. A Limited Liability Company (LLC) is formed by 1 or more. Limited Liability Company (LLC) An LLC is a hybrid between a partnership and a corporation. Members of an LLC have operational flexibility and income benefits. The Limited Liability Company (LLC) is a business entity Different types of insurance coverage are available to lessen the perils of having one's. converts into a different type of domestic or foreign entity. The. Ohio Revised Code chapter governing each type of entity must permit the conversion. For. Each state has its own rules regarding LLCs, but the legal structure is similar. The owner of an LLC is a member, and LLCs can have one member or multiple. An LLC is a type of unincorporated association, distinct from a corporation. LLC, or where an LLC's identified legal owners are another anonymous company.

Abrir Una Cuenta En Td Bank

The TD Bank Simple Savings account has no monthly maintenance fee for 12 months, or ever with just a $ minimum daily balance. Learn more and open an. Cuánto invertir en Acciones de TD:Decida cuánto invertir en acciones de TD. · Abrir la cuenta de trading:Para abrir cuenta de trading debe ir a la página 'Abrir. Open a TD Savings Account online in minutes – it's easy and secure. Choose your FDIC-insured savings account with competitive interest rates. You can manage your Samsung Financing account online on the TD Bank website anytime to: Pay your bill; View account activity; View available credit; Check your. Easily pay your bill, update your credit card or banking details. It's fast & convenient. Access your insurance documents. Barclays Online Banking offers high yield savings accounts and CDs with no minimum balance to open. Learn more. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Every TD Checking Account comes with a free Visa® Debit Card: One card, so many ways to pay – make purchases and pay bills in person, online, over the phone or. Unlock great perks with a TD Complete Checking Account. Get a free linked savings account, Early Pay, and waived fees for students and young adults. The TD Bank Simple Savings account has no monthly maintenance fee for 12 months, or ever with just a $ minimum daily balance. Learn more and open an. Cuánto invertir en Acciones de TD:Decida cuánto invertir en acciones de TD. · Abrir la cuenta de trading:Para abrir cuenta de trading debe ir a la página 'Abrir. Open a TD Savings Account online in minutes – it's easy and secure. Choose your FDIC-insured savings account with competitive interest rates. You can manage your Samsung Financing account online on the TD Bank website anytime to: Pay your bill; View account activity; View available credit; Check your. Easily pay your bill, update your credit card or banking details. It's fast & convenient. Access your insurance documents. Barclays Online Banking offers high yield savings accounts and CDs with no minimum balance to open. Learn more. Welcome to TD Bank! Explore our banking services, credit cards, loans, home lending, and other financial products for you and your business. Every TD Checking Account comes with a free Visa® Debit Card: One card, so many ways to pay – make purchases and pay bills in person, online, over the phone or. Unlock great perks with a TD Complete Checking Account. Get a free linked savings account, Early Pay, and waived fees for students and young adults.

RBC Ranks #1 in the J.D. Power Canada Online Banking Satisfaction Study. How to get your RBC iPad Offer. Numbers. Open an eligible RBC bank account. TD Bank TD Essential Banking. The First Bank of Greenwich Basic Checking Banco Popular of Puerto Rico Cuenta Popular · Bangor Savings Bank Benefit. Make an appointment at your nearest TD branch to learn more about banking, investing, borrowing, credit card services and more. With your new IDNYC Card, you can open a bank or credit union account at one of several financial institutions across New York City. Visit now to learn about open a TD Bank small business checking account online, all of which have live 24/7 customer support, secure mobile & online banking. TD Ameritrade, Inc. ("Ameritrade") Member SIPC, a subsidiary of The Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal. tion: Sign into your My TD account to access and manage your bank accounts, cards, loans and more online and enjoy a personalized totravelme.ru experience. Step offers a free FDIC insured bank account and Visa card designed for the next generation. Start building your financial future today! Maine is currently the only state that allows enrollment at their participating Bank of Bangor. Can I open an account in multiple ABLE programs? No, a person is. Explore our flexible student bank accounts and digital tools to help you manage your money. Plus, get plenty of information on how to start your financial. What you need to open a TD Essential Banking Account · 1. The basics. Name, address, phone number and email. · 2. Proof of ID. Social Security Number, birthdate. TD Ameritrade, Inc. is now at Charles Schwab. Use your existing account information and log in to explore new account and wealth management opportunities at. Access no-fee daily banking and great Savings rates with Tangerine. Secure and savvy saving starts here. Sign up today! You can manage your Samsung Financing account online on the TD Bank website anytime to: Pay your bill; View account activity; View available credit; Check your. Bank anywhere, anytime with the TD Bank app for personal and business accounts. The TD Bank app has a fresh new look that makes banking more convenient than. TD Canada. + Comparar. Scotiabank Mobile Banking. Tim Hortons. CIBC Mobile Banking®. Bank cuenta las «Instalaciones actuales» y los «Usuarios activos» en el. Get a list of all the documents you need to open up a small business deposit account or apply for a small business loan or line of credit from TD Bank. Cuánto invertir en Acciones de TD:Decida cuánto invertir en acciones de TD. · Abrir la cuenta de trading:Para abrir cuenta de trading debe ir a la página 'Abrir. Click Withdraw Now under Bank account; Click Add a bank account and select country: Canada; In the first field, enter the SWIFT code of your bank; In the second.