totravelme.ru Gainers & Losers

Gainers & Losers

Make Interest On Crypto

Invest in crypto and earn up to 10% APY interest. AQRU offers the perfect way to earn interest on your crypto portfolio. Our easy to use platform tracks your. Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications. With Coinbase Earn, we'll help you put your assets to work in the cryptoeconomy so you can grow your crypto holdings with little effort. Bitcoin Lending Interest Rates. Interest rates on bitcoin lending platforms can range anywhere between % APY (Annual Percentage Yield), depending on the. Earn interest by lending your crypto - like on Binance. · Open a crypto interest account - like on BlockFi. · Open a crypto savings account - like on Coinbase. Earn with CoinLoan Increase the value of your holdings — start earning interest on your idle assets from the moment you make a deposit. % p.a. Cryptocurrency can be used to earn passive income. Learn how some people are using virtual currency as a supplemental income source. As the option to earn interest in NEXO Tokens is not available in the Base Loyalty tier, the daily interest will be calculated in kind using the compound model. Open the Nexo app. Enter your 'Savings Hub' and click on 'Earn on Nexo'. Choose the 'Interest Payout in NEXO Tokens' option. 3. Create a Fixed Term for bonus. Invest in crypto and earn up to 10% APY interest. AQRU offers the perfect way to earn interest on your crypto portfolio. Our easy to use platform tracks your. Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications. With Coinbase Earn, we'll help you put your assets to work in the cryptoeconomy so you can grow your crypto holdings with little effort. Bitcoin Lending Interest Rates. Interest rates on bitcoin lending platforms can range anywhere between % APY (Annual Percentage Yield), depending on the. Earn interest by lending your crypto - like on Binance. · Open a crypto interest account - like on BlockFi. · Open a crypto savings account - like on Coinbase. Earn with CoinLoan Increase the value of your holdings — start earning interest on your idle assets from the moment you make a deposit. % p.a. Cryptocurrency can be used to earn passive income. Learn how some people are using virtual currency as a supplemental income source. As the option to earn interest in NEXO Tokens is not available in the Base Loyalty tier, the daily interest will be calculated in kind using the compound model. Open the Nexo app. Enter your 'Savings Hub' and click on 'Earn on Nexo'. Choose the 'Interest Payout in NEXO Tokens' option. 3. Create a Fixed Term for bonus.

Compare Reward Rates. Compare Reward Rates ; Cronos Icon. Cronos. up to 6% ; Bitcoin Icon. Bitcoin. up to 5% ; Ethereum Icon. Ethereum. up to % ; Tether Icon. Via the main Coinbase app or website, eligible users can stake Tezos, Cosmos, or ETH and earn as much as 6% APY (depending on the type of asset being staked) as. Earn users who plan to withdraw crypto will need to submit makes other clarifying adjustments in the interest of creditors, including Earn users. Crypto interest-bearing platforms essentially work like savings accounts for your crypto - except in most instances the interest rates offered are far higher. Covers how to earn interest on crypto, crypto staking rewards, crypto rewards credit cards, crypto lending, crypto rewards apps, and crypto interest rates. Earn crypto yield on BTC, ETH, DOT, SOL, ATOM and stablecoins (USDT, USDC). Open a Yield App crypto account and earn up to 25% p.a. via web and crypto app. YouHodler. You can get good interest on Tether with your USDT savings account on YouHodler. Your USDT could be fetching you as much as % APR compound. Crypto savings accounts allow investors to earn interest on their crypto assets by lending them out at a set rate. Here's our top picks. In general, cryptocurrency is subject to ordinary income tax and capital gains tax. How is cryptocurrency taxed? When you earn cryptocurrency interest, you'll. For example, if you invest $1, in a crypto savings account that earns 5% interest annually, you'll earn $50 in interest in the first year. In the second year. Our rates beat most savings accounts and traditional investing. We offer up to 15% p.a. on major cryptocurrencies and stablecoins so you can grow your portfolio. Can I make more than one allocation for Crypto Earn? ; Cardholder CRO Stake or CRO Lockup. Maximum. (USD equivalent) ; Equivalent to USD $, $2 Hodlnaut helps you earn up to % APY on your cryptocurrency. Sign up today, for your crypto interest account with simple KYC process and gain %. How to start earning interest on crypto Use your wallet to send deposit amount to the provided unique address via scanning qr-code or copying address. Process. The Hodlnaut Crypto Interest Account lets you earn interest on crypto with up to % APY. Deposit your crypto and start earning immediately with no lock-in. Normally any tokens you use in your collateral wallet to borrow assets earn 0 yield. That's why even 0% interest loans aren't as crazy as they. Another popular option for earning interest with your crypto is to use KuCoin. This global exchange is known for its extensive asset support and variety of. DOGE pays out 1% in-kind, or 3% in NEXO. All others, including Bitcoin and Ethereum, yield at least 6% annually. The highest possible rates you can receive are. Sign up with Matrixport today to start earning interest with crypto! New users can enjoy up to 35 USDC Dual Currency coupons. Register now! The interest could be between 3% and 7% or as high as 17% with stablecoins. Remember that crypto collateral that borrowers had to pledge to get a loan? If a.

Ripple Revenue

I assume Ripple doesn't aim to make money off xrp, so just wondering whether there's any relationship between how well the company is doing and the price of. Want to be a part of our journey or curious to know how RippleWorx can make waves for your business? Contact us at: [email protected] revenue by March. What is the annual revenue of Ripple? The Ripple annual revenue was $ million in revenue. Founded in , Ripple's vision is to enable a world where value moves as seamlessly as information flows today—an Internet of Value. Ripple is. The FinTech Fraud Ripple Effect details the myriad ways in which fraud can cut into FinTechs' bottom lines and how fraud impacts the end user experience. We support them with techniques and networks to help grow their revenue and provide for their families. Read more. Chantal lives in Rwanda with her husband. In March , Ripple announced a $ Million fund for gaming developers which would be overseen by Forte. The current revenue for Ripple Labs is How much funding has Ripple Labs raised over time? Ripple Labs has raised $M. Who are Ripple Labs's investors. Explore charts related to Ripple XRP's transaction volume, counts, and revenue dynamics. I assume Ripple doesn't aim to make money off xrp, so just wondering whether there's any relationship between how well the company is doing and the price of. Want to be a part of our journey or curious to know how RippleWorx can make waves for your business? Contact us at: [email protected] revenue by March. What is the annual revenue of Ripple? The Ripple annual revenue was $ million in revenue. Founded in , Ripple's vision is to enable a world where value moves as seamlessly as information flows today—an Internet of Value. Ripple is. The FinTech Fraud Ripple Effect details the myriad ways in which fraud can cut into FinTechs' bottom lines and how fraud impacts the end user experience. We support them with techniques and networks to help grow their revenue and provide for their families. Read more. Chantal lives in Rwanda with her husband. In March , Ripple announced a $ Million fund for gaming developers which would be overseen by Forte. The current revenue for Ripple Labs is How much funding has Ripple Labs raised over time? Ripple Labs has raised $M. Who are Ripple Labs's investors. Explore charts related to Ripple XRP's transaction volume, counts, and revenue dynamics.

MarketSupplyAddressesNetwork ActivityFees and RevenueSocial. News. AllCurated Ripple XRPRippleRipple VenturesXpring. Key Developments. Notable Events. Ripple Revenue | 11 followers on LinkedIn. A Marketing Agency Focus On Strategic Marketing & Funnel Designing To Solve Even Your Worst Marketing Problem. Ripple's Profile, Revenue and Employees. Ripple is an online news portal that covers politics, technology, science, local news and entertainment. RippleNet, Ripple's financial technology network, leverages crypto and profits, lost savings and lost revenues, whether in negligence, tort. What is Ripple's Revenue? Ripple's revenue is $ Million What is Ripple's SIC code? Ripple's RippleNet payments network utilizes the XRP Ledger blockchain revenue streams by offering end customers the ability to buy, sell, and hold. Conversation. Dr. William J. Ripple · @WilliamJRipple. All about the revenue. Image. PM · Jul 16, ·. K. Views. See Ripple funding rounds, investors, investments, exits and more. Evaluate their financials based on Ripple's post-money valuation and revenue. Revenue Intelligence Senior Analyst · The opportunity to build in a fast-paced start-up environment with experienced industry leaders · A learning environment. Body: The financial reports of Ripple Labs have been subject to significant scrutiny lately, particularly regarding the company's revenue streams and cash flow. Join the success stories with Ripple Revenue's unique concert marketing services. Transform your events into packed, unforgettable experiences with our. Followers, Following, 58 Posts - Ripple Revenue (@ripplerevenue) on Instagram: "I help Live Music Event Sell mOre Tickets Download Our " 7 Myths. Discover Ripple Revenue, a Databox-certified partner certified in advanced reporting and analytics. Databox is a data analytics software for creating. Ripple's revenue is $ - Learn more about Ripple's revenue by exploring their annual revenue, historical revenue, quarterly revenue, and revenue per. Ripple Revenue provides services in digital marketing, campaign design, data-driven marketing strategy, and retargeting campigns. As a private company, Ripple does not need to disclose any financials, so revenues are not known. Based on some estimates, the company was worth as much as. Discovery Company profile page for Ripple Labs, Inc. including technical research,competitor monitor,market trends,company profile& stock symbol. Elevate Your Impact with Corporate Volunteerism. · Boost program funding with volunteer grant revenue. Don't miss out on key opportunities to turn supporter time. Find company research, competitor information, contact details & financial data for RIPPLE REVENUE LLC of Saint Louis, MO. Get the latest business insights. Ripple Recruiting hit $M revenue and 75 customers in We match students and recent graduates with full time jobs and internships at companies around.

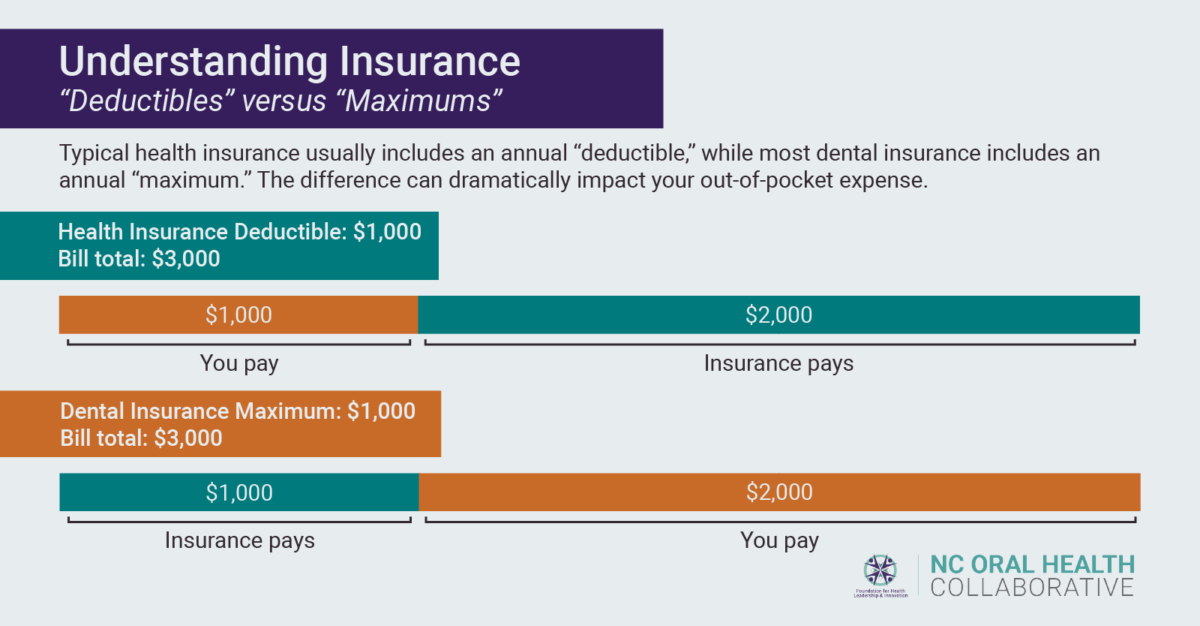

What To Do If Dental Insurance Is Maxed Out

A dental annual maximum is the total amount your dental plan will pay toward your care in a month period (also known as the benefit period). You've maxed out your plan (used up all your benefits on other procedures) and no longer have coverage until the plan resets next benefit period. Think about it. What is a dental insurance annual maximum? Learn what counts towards a dental insurance maximum, how to check what your maximum is, and how to avoid maxing out. Learn more about ACA coverage and other ways to pay for dental care If you need help with dental coverage offered through the Health Insurance Marketplace. While you can also see an out of network dentist, it's worth your while to stay in-network: You don't need to submit a claim, and you get significant discounts. Some plans will allow you to tap into your annual maximum's value if you do not spend it all in one year. Some dental plans, for example, will allow you to roll. A good way to delay maxing out your insurance is by getting a $5, annual maximum dental insurance plan from Spirit Dental. Once you meet your deductible, we. Some benefit plans waive deductibles for preventive and diagnostic services; be sure to check your benefits before your dental visit to see if this applies to. Contact Your Insurance Company: Call or email your insurance company's customer service department. Provide your policy number and the effective. A dental annual maximum is the total amount your dental plan will pay toward your care in a month period (also known as the benefit period). You've maxed out your plan (used up all your benefits on other procedures) and no longer have coverage until the plan resets next benefit period. Think about it. What is a dental insurance annual maximum? Learn what counts towards a dental insurance maximum, how to check what your maximum is, and how to avoid maxing out. Learn more about ACA coverage and other ways to pay for dental care If you need help with dental coverage offered through the Health Insurance Marketplace. While you can also see an out of network dentist, it's worth your while to stay in-network: You don't need to submit a claim, and you get significant discounts. Some plans will allow you to tap into your annual maximum's value if you do not spend it all in one year. Some dental plans, for example, will allow you to roll. A good way to delay maxing out your insurance is by getting a $5, annual maximum dental insurance plan from Spirit Dental. Once you meet your deductible, we. Some benefit plans waive deductibles for preventive and diagnostic services; be sure to check your benefits before your dental visit to see if this applies to. Contact Your Insurance Company: Call or email your insurance company's customer service department. Provide your policy number and the effective.

Not paid their deductible.- This is a once a year payment that is due to the dental office. Not paid because their insurance “maxed out”.- If you need a lot of. The best thing to do is call your insurance company and ask specific questions. Ask if there are dentists in network, who they are, where they are located, and. What should you do when you max out your dental insurance? The good news is that many people don't end up hitting the annual max on their dental plans. You can use any licensed dentist. However, if you visit an out-of-network dentist you may have higher out-of-pocket costs than if you use a dentist that is in-. If your plan's annual maximum is $1,, your dental benefits provider will pay for their portion of your dental work based on your plan's coverage/coinsurance. DHMOs typically do not have annual maximums. This means you don't risk running out of benefits. DHMOs are a good fit for some people but offer fewer choices. Out-of-pocket costs: Even if your dental plan has no annual maximum, you will be responsible for copayments. · Premium: Dental insurance premiums depend on a. If you don't receive a cleaning or exam, you won't be eligible to roll over any of your benefit dollars to the following year. In addition, your paid claims. If you have had treatment and you are maxed out with the insurance, they will not pay for cleaning or anything else. Most preventive services DO come out of. How do I get dental insurance and what does it cost? · Can I buy dental insurance without having health insurance? · What's the difference between network and out. If a dental office cannot determine which plan is primary, a call to the state insurance commissioner's office could be made to determine primary versus. Learn about dental savings plans and dental insurance, how to save money on If you do not allow these cookies we will not know when you have. Each year, millions of dollars are wasted by not maxing out your dental benefits or using up the money set aside in your FSA. Most dental insurance companies. Log into your dental insurance company's website with your username and password. Once you do, you should be able to find all the details of your plan in your. Each time a dental claim is submitted by your dentist, your dental insurance provider subtracts the cost that they have paid for the service from your maximum. Find out how to increase your chances of a successful claim submission, and what to do when you receive a claim rejection. Understanding the ins-and-outs of. You will want to check with your dental insurance carrier to see when your maximum annual benefit resets. Some reset on your one year anniversary of having the. Or, you can reduce your coverage if you've been covered under the existing benefits for at least 12 consecutive months. If you experience big life changes such. If you are paying your dental insurance premiums every month, you should be using your benefits. · Most plans typically pay % for preventive visits, so if you. What to do if dental insurance is maxed out? If you've reached your dental insurance maximum for the year, consider the following options: • Discuss payment.

How Much Do They Pay You To Give Plasma

Federal regulations allow individuals to donate plasma as often as twice in seven days if the donations occur two days apart from each other. What are the. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. Plasma donation centers in the U.S. compensate donors, and many allow frequent donations. How often can you donate plasma and is it healthy? Earn up to $ per week as a Repeat Donor by donating two times in the same week (donation weeks begin Monday and end Saturday)! Be sure to ask about. When it comes to reporting income from plasma donation on your tax return, this income should be reported on Schedule 1 (Form ), specifically on line 8. A: Yes, you will be compensated; the amount of compensation is dependent on the amount of plasma you donate. For example, if you donate less than ml, you. How much do you pay for plasma and platelet donations? First-time donations pay $ Second donation pay $50 with a $50 bonus for becoming a qualified donor. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. Federal regulations allow individuals to donate plasma as often as twice in seven days if the donations occur two days apart from each other. What are the. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. Plasma donation centers in the U.S. compensate donors, and many allow frequent donations. How often can you donate plasma and is it healthy? Earn up to $ per week as a Repeat Donor by donating two times in the same week (donation weeks begin Monday and end Saturday)! Be sure to ask about. When it comes to reporting income from plasma donation on your tax return, this income should be reported on Schedule 1 (Form ), specifically on line 8. A: Yes, you will be compensated; the amount of compensation is dependent on the amount of plasma you donate. For example, if you donate less than ml, you. How much do you pay for plasma and platelet donations? First-time donations pay $ Second donation pay $50 with a $50 bonus for becoming a qualified donor. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the.

The average pay range for a Plasma Donors varies little (about $), which suggests that regardless of location, there are not many opportunities for increased. Learn how you too can make some extra cash by donating plasma. Read this blog post to discover my experience at BioLife Plasma and how you can get up to. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. You can help people in so many different situations. It's a crucial part of saving someone's life. If it wasn't for the plasma I was given, I would have died. How much you'll make for donating plasma will vary, depending on what part of the country you're in and which plasma center you're using. Some of the bigger. How does the donation process work? Unlike a whole blood donation, where you give whole blood with all three blood components—plasma donations use a special. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. How you get paid Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can. Typically you can earn $$75 each time you donate plasma. Since plasma is in such high demand, many companies have started offering extra incentives for new. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. How to Donate Plasma in Cherry Hill · Why Should You Donate Plasma? · What Are the Plasma Donor Eligibility Requirements in Cherry Hill? · Frequently Asked. Discover how easy and rewarding plasma donation can be by learning more about our eligibility requirements, process, and compensation offers. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. Who can donate? · How do I donate plasma? · Does it hurt? · Is donating plasma safe? · What type of medical screening and testing is done? · How do you get my plasma. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. They promise that a new donor can earn up to $ in their first month with BioLife plasma. What Makes This Option Great. BioLife offers excellent incentives.

Best Tax Exempt Bond Etf

Best Fit Muni National Interm · #1. Columbia Multi-Sector Municipal Inc ETF MUST · #2. Vanguard Tax-Exempt Bond ETF VTEB · #3. iShares National Muni Bond ETF MUB. Tax-Advantaged Bond etf ; TREASURY BILL 07/25 , ; LAMAR TX CONSOL INDEP SCH DIST LAMSCD 02/53 FIXED 5, ; CAPITAL AREA HSG FIN CORP TX CPAMFH 08/ Highlights · A straightforward, low-cost fund offering potential tax-efficiency · The Fund can serve as part of the core of a diversified portfolio · Simple access. The Fund invests primarily in investment-grade municipal bonds and is designed to provide as high a level of current interest income exempt from regular federal. Each ETF is placed in a single “best fit” ETF Database Category; if you want to browse ETFs with more flexible selection criteria, visit our screener. To see. The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. Vanguard Tax-Exempt Bond ETF (VTEB) - Find objective, share price, performance, expense ratio, holding, and risk details. The SPDR® Nuveen Bloomberg Municipal Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and. 1. SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF · 2. VanEck Vectors High Yield Municipal Index ETF · 3. BlackRock High Yield Muni Income Bond ETF. Best Fit Muni National Interm · #1. Columbia Multi-Sector Municipal Inc ETF MUST · #2. Vanguard Tax-Exempt Bond ETF VTEB · #3. iShares National Muni Bond ETF MUB. Tax-Advantaged Bond etf ; TREASURY BILL 07/25 , ; LAMAR TX CONSOL INDEP SCH DIST LAMSCD 02/53 FIXED 5, ; CAPITAL AREA HSG FIN CORP TX CPAMFH 08/ Highlights · A straightforward, low-cost fund offering potential tax-efficiency · The Fund can serve as part of the core of a diversified portfolio · Simple access. The Fund invests primarily in investment-grade municipal bonds and is designed to provide as high a level of current interest income exempt from regular federal. Each ETF is placed in a single “best fit” ETF Database Category; if you want to browse ETFs with more flexible selection criteria, visit our screener. To see. The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. Vanguard Tax-Exempt Bond ETF (VTEB) - Find objective, share price, performance, expense ratio, holding, and risk details. The SPDR® Nuveen Bloomberg Municipal Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and. 1. SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF · 2. VanEck Vectors High Yield Municipal Index ETF · 3. BlackRock High Yield Muni Income Bond ETF.

Was thinking it might be a good idea to have a muni bond fund in the taxable account, saw that JP Morgan has one called JMHI, was wondering. Tax-exempt muni bonds hold numerous advantages over corporate bonds—a big one is that the interest investors earn is exempt from federal taxes and most state. good decision, you can ease your mind by purchasing insurance for the bond. Are Municipal Bonds ETFs Tax-Exempt? Municipal bonds ETFs are generally free. The iShares New York Muni Bond ETF seeks to track the investment results of an index substantially composed of investment-grade municipal bonds issued in. 53 ETFs are placed in the National Municipal Bond Category. Click to see Returns, Expenses, Dividends, Holdings, Taxes, Technicals and more. Investing in an in-state tax-free municipal bond may offer advantages, but there can be good reasons to consider out-of-state munis. Read on to learn more. Municipal Bond Funds and ETFs invest the majority of their assets in tax-advantaged municipal bonds. The funds can include bonds issuers in the same state. The Tax-Exempt Bond Fund of America (Class A | Fund 19 | AFTEX) seeks to tax-exempt securities rated in the three highest categories. Maturity. The Invesco National AMT-Free Municipal Bond ETF seeks to track an index of tax-exempt municipal debt that is not subject to the alternative minimum tax (AMT). Also worth noting: Treasuries are also state and local tax exempt, plus they're safer and have lower correlations with equities. In other words. The largest Muni ETF is the iShares National Muni Bond ETF MUB with $B in assets. In the last trailing year, the best-performing Muni ETF was ZTAX at An issue that continues to plague the muni market is low relative yields, even though absolute yields are near the highest level in two decades. The yield for. South Carolina Municipal Income Fund (A) (EASCX) - A credit-focused approach to single-state municipal bond investing. - Municipal Income - State Fund. To learn more about municipal bond and tax-free investing, please visit our Fixed Income Research Center. As always, you should consult a tax professional for. The BlackRock High Yield Muni Income Bond ETF (the “Fund”) primarily seeks to maximize tax free current income and secondarily seeks to maximize capital. HYD - Overview, Holdings & Performance. The ETF is a high-yield muni focus whose underlying index is comprised of the highest-yielding municipal bonds. You're interested in investing in municipal bonds, but which type—general obligation or revenue—is best for you? We break it down. Both VTEB and MUB offer tax advantages by investing in municipal bonds, but there are some key differences between the two ETFs. VTEB has a slightly lower. Mairs & Power Minnesota Municipal Bond Exchange Traded Fund (ETF) · Invests primarily in Minnesota municipal bonds · Monthly income distribution exempt from.

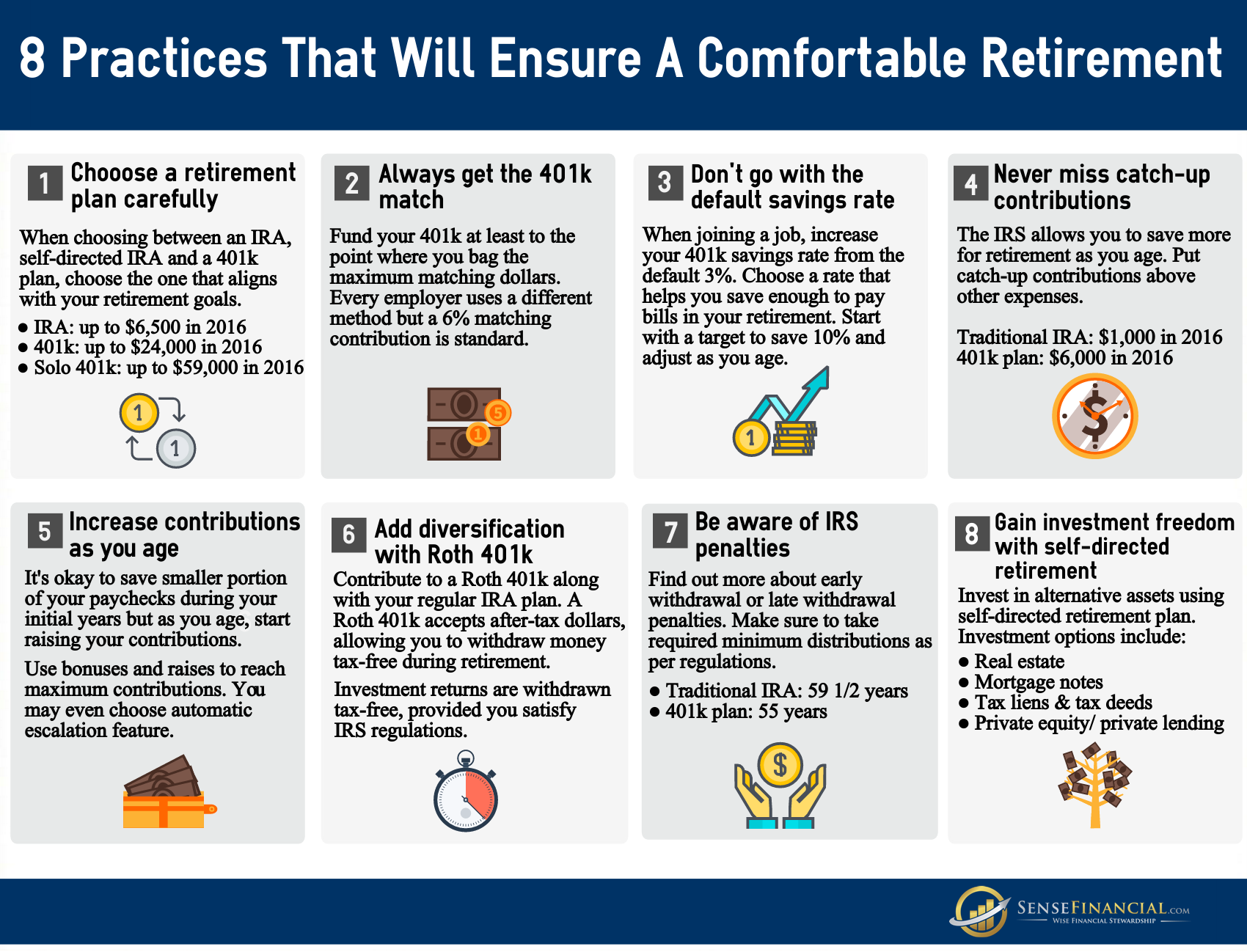

Top 10 Retirement Plans

Top 10 Ways to Prepare for Retirement (PDF) - Provides information on assessing your retirement needs, tax benefits of workplace savings plans, and Individual. 10 retirement planning tips to consider. Who better to ask how to plan for The best way to plan a budget is to know how much you can spend. But alas. Contribute to your employer's retirement savings plan. If your employer offers a retirement savings plan, such as a (k) plan, sign up and contribute all you. Top 10 Pension Plans in India ; ABSLI Empower Pension Plan. 25 years to 70 years. 80 years ; Kotak Premier Pension Plan. 30 years to 60 years. 45 years to Washington public service retirement · Get to know your plan · FAQ · Top searches · Calculators · What is DCP? Find out. · Grow your wealth · Events. retirement plans and disability retirement. Name of Retirement Plan, Type of Retirement Plan, Criteria to Receive. Final Pay, Defined Benefit that equals Common employer retirement plans · 1. (k) plan. · 2. (b) plan. · 3. Defined benefit plan (pension plan). Overview of Top 15 Pension Plans in India · Bajaj Allianz LongLife Goal Plan · ABSLI Wealth Smart Plus Plan · Tata AIA Fortune Maxima Plan · Max Life Flexi Wealth. If you're saving for retirement, you have several strategies to choose from. The best retirement plans are typically tax-advantaged accounts like (k)s. Top 10 Ways to Prepare for Retirement (PDF) - Provides information on assessing your retirement needs, tax benefits of workplace savings plans, and Individual. 10 retirement planning tips to consider. Who better to ask how to plan for The best way to plan a budget is to know how much you can spend. But alas. Contribute to your employer's retirement savings plan. If your employer offers a retirement savings plan, such as a (k) plan, sign up and contribute all you. Top 10 Pension Plans in India ; ABSLI Empower Pension Plan. 25 years to 70 years. 80 years ; Kotak Premier Pension Plan. 30 years to 60 years. 45 years to Washington public service retirement · Get to know your plan · FAQ · Top searches · Calculators · What is DCP? Find out. · Grow your wealth · Events. retirement plans and disability retirement. Name of Retirement Plan, Type of Retirement Plan, Criteria to Receive. Final Pay, Defined Benefit that equals Common employer retirement plans · 1. (k) plan. · 2. (b) plan. · 3. Defined benefit plan (pension plan). Overview of Top 15 Pension Plans in India · Bajaj Allianz LongLife Goal Plan · ABSLI Wealth Smart Plus Plan · Tata AIA Fortune Maxima Plan · Max Life Flexi Wealth. If you're saving for retirement, you have several strategies to choose from. The best retirement plans are typically tax-advantaged accounts like (k)s.

In-service withdrawals - Yes, but subject to possible 10% penalty if under age /2. Return to Top. Participate in a (b) plan. The following employees are. (k) providers offer a tax-advantaged k retirement savings plan that allows employers and employees of private, for-profit companies to contribute with. If you retire from a career in the military, you may be eligible for a pension. The plan and benefits you will receive depend on your situation. 56 years, 10 months. After , 57 years. Back to Top. MRA (Minimum Retirement Age) + 10 Retirement. To qualify for an MRA + 10 retirement you must meet the. 5 Companies With the Best Retirement Plans · 1. ConocoPhillips (COP) · 2. The Boeing Company (BA) · 3. Amgen Inc. (AMGN) · 4. Philip Morris International Inc. (PM). Discover the best Retirement Planning in Best Sellers. Find the top most popular items in Amazon Kindle Store Best Sellers. All | All · k Advisors Intermountain. k Advisors Intermountain · Achieve Retirement. Achieve Retirement · Ascende Wealth Advisers, Inc. Ascende Wealth. Top Defined Contribution ; $,, $,, $, ; $59,, $74,, $69, Nonprofit organizations and government agencies tend to offer (b) plans. They're a lot like (k)s—in most cases, you devote a certain amount pre-tax with. Morningstar's Top Minimalist Fund Picks to Simplify Your Retirement Portfolio ; Vanguard Wellington™ Inv. (VWELX) ; American Funds Washington Mutual F1. (WSHFX). Best Retirement Plans in India For NRIs in USA ; Max Life Forever Young Pension Plan, 30 years years, years of age, 10 years to 75 years-Entry age. Top 10 Ways to Prepare for Retirement (PDF) - Provides information on benefits of workplace savings plans, and Individual Retirement Accounts (IRAs). A (k) is the most common type of employer-sponsored retirement plan. Your employer preselects a few investment choices and you defer a portion of each. (k) providers offer a tax-advantaged k retirement savings plan that allows employers and employees of private, for-profit companies to contribute with. retirement plans and disability retirement. Name of Retirement Plan, Type of Retirement Plan, Criteria to Receive. Final Pay, Defined Benefit that equals Plan how to best use your remaining work income, such as using your last bonus to pay off your car so you can retire debt-free. If you still have family and. Examples of retirement plans include funds held in an individual retirement arrangement (IRA), retirement plans for self-employed individuals, and in some cases. Concerned about your post retirement life? Start now with HDFC Life pension plans and build your retirement corpus to enjoy a worry-free retirement. (k) Plans. This is the most popular type of employee retirement plan because it has higher contribution limits for employees and offers a choice of pretax or. The New York State Common Retirement Fund is one of the largest public pension plans best-managed and best-funded plans in the nation. Since its establishment.

Tailored Fit Vs Slim Fit

It differs a lot. One brand/designer's slim fit might be another's regular fit. In general, tailored fit is slimmer than slim fit. A Tailored-Fit garment has a larger chest than belly size. Therefore, it is the perfect alternative when you find Slim-Fit too tight. Slim-fit pants are more form-fitting and have tapered legs. They are ideal for men who are of slim build or who want a more fashionable look. Classic and Tailored Fit? To access our Fit Guide for ALL Peter Millar products click HERE totravelme.ru totravelme.ru A tailored fit is typically tighter around the torso and body than a slim fit. A slim fit shirt is also more tailored (fitted) around the arms than standard. The tailored fit is great for men with athletic or average physiques. Another advantage of the tailored fit is that it has allowance for further tailoring, so. Whereas modern fit suits project modernity, sharp dressing, and cool confidence, slim fit suits are snappier and more daring while retaining contemporary. The main difference between the two is that a tailored fit is cut close to the body. Tailored fitting clothes are tighter than a regular or slim fit but not as. Tailored fit suits work well as a 3-piece, like our Italian blue check. It sculpts the silhouette while offering a bit more room than the slim fit, and works. It differs a lot. One brand/designer's slim fit might be another's regular fit. In general, tailored fit is slimmer than slim fit. A Tailored-Fit garment has a larger chest than belly size. Therefore, it is the perfect alternative when you find Slim-Fit too tight. Slim-fit pants are more form-fitting and have tapered legs. They are ideal for men who are of slim build or who want a more fashionable look. Classic and Tailored Fit? To access our Fit Guide for ALL Peter Millar products click HERE totravelme.ru totravelme.ru A tailored fit is typically tighter around the torso and body than a slim fit. A slim fit shirt is also more tailored (fitted) around the arms than standard. The tailored fit is great for men with athletic or average physiques. Another advantage of the tailored fit is that it has allowance for further tailoring, so. Whereas modern fit suits project modernity, sharp dressing, and cool confidence, slim fit suits are snappier and more daring while retaining contemporary. The main difference between the two is that a tailored fit is cut close to the body. Tailored fitting clothes are tighter than a regular or slim fit but not as. Tailored fit suits work well as a 3-piece, like our Italian blue check. It sculpts the silhouette while offering a bit more room than the slim fit, and works.

Our fits: The comparison · Regular Fit · Trim Fit · Slim Fit · Casual · Regular · Trim · Slim. The main difference between the two is that a tailored fit is cut close to the body. Tailored fitting clothes are tighter than a regular or slim fit but not as. Choose Your Fit · Slim Fit Our Slimmest cut - fits closest to the body · Tailored Fit Our Regular cut - Designed to fit most men well · Classic Fit Our Fullest Cut. Trimmer in the body and arms for a comfortably fitted silhouette. Our tailored fit strikes a balance between our Classic and Slim options. Classic Fit: Offers the most room, ensuring comfort. · Slim Fit: Features a narrow cut, creating a modern, sleek silhouette. · Modern Fit: Strikes a balance. The most significant difference then, between a slim fit and a tailored fit is the fit at the arms, waist, and chest. Unfortunately, the difference isn't too. Classic and Tailored Fit? To access our Fit Guide for ALL Peter Millar products click HERE totravelme.ru totravelme.ru Pants. Choose A Fit: Skinny Fit. Slim Fit. Tailored Fit. Traditional Fit. Default Do Not Sell Or Share My Personal Information; ACCESSIBILITY STANDARDS. Cut reasonably close, our Tailored Fit shirts offer slightly more space in the chest and body, then taper gently at the waist to ensure a neat silhouette. The. Dress comfortably for the road ahead. Visit our fit guide so that our mens sport shirts, tailored fit trousers + comfortable dress pants are perfectly. The Tailored fit creates a flattering sleek silhouette that slightly tapers down through the waist and emphasises the chest. The Slim Fit is our most. Body type: Different shirt fits flatter different body types. For example, if you have a slim build, a tailored- fit shirt may be more flattering, while. Slim fit is narrowest in suits after skinny. The jacket is made to fit close to the body from the sleeves, waist, chest, and shoulder. While trousers sit below. Slim fit shirts typically have narrower sleeves and a more tapered waist, making them a great choice for individuals with a slimmer or athletic build. They're. A modern fit suit is cut slightly slimmer than traditional suits, while a slim-fit suit is much more fitted. Tailored fit is a sleek and timeless style of suit. It is not as roomy as a Regular Fit suit and less fitted than a Slim or Skinny Fit suit. Our classic slim fit two-piece is more fitted than a regular but looser than a skinny version. It's narrow through the waist, shoulder and sleeve, with a. A tailored-fit shirt sits in between a regular and slim fit. This shirt gently tapers at the waist to create a flattering appearance. Find the right cut suit for your build & style. Choose from our Traditional Fit suits, the trimmer cut Tailored Fit, and Slim Fit suits - the narrowest cut. Slim Fit · The Classic Fit is versatile with a masculine silhouette that is broad fitting and generous through the shoulders, chest and waist. · The Tailored fit.